NEW ORLEANS — The federal government’s announcement last week of up to 12 more lease sales on both coasts by 2028 means more demand (and potential work opportunities) for vessels and ports, including the Port of New Bedford.

Interior Secretary Deb Haaland made the announcement at a wind industry conference in New Orleans, where she and other federal officials also shared the news of millions in funding for offshore wind research, and the streamlining of rules governing how the government holds auctions and reviews projects.

“This is so exciting because it means that developers and communities can expect predictability and transparency as they plan for future projects,” Haaland said. “It also means that all stakeholders from tribes to states to fisheries to academia have more time to weigh in on the process.”

The closest lease sales to Massachusetts will be the Gulf of Maine this year, and the New York Bight, in 2027 (the last one was in 2022 with six areas going to bid). There were no announced lease sales for the coast of Massachusetts and Rhode Island.

Lease sales will also occur in California, Hawaii, and an unspecified U.S. Territory in 2028. Each sale could see several areas leased.

Haaland last made a similar announcement in 2021 that the government would hold up to seven offshore wind lease sales by 2025.

This year, the government plans to auction leases in the Gulf of Mexico, Oregon, the Central Atlantic, and the Gulf of Maine.

Asked how many leases could go for auction, a BOEM spokesperson said the final size and number will be announced in upcoming sale notices for this year, as the wind energy areas have already been identified.

For sales in the coming years, including for the New York Bight, the spokesperson said there will be “extensive planning processes” involving public input for identifying new or existing areas that could be included.

The New York Bight is an area of interest and concern for the fishing industry and the Port of New Bedford, as it overlaps with scallop grounds. It’s a block of ocean between New York and New Jersey frequented by fishermen from the Carolinas to New Bedford. Fishermen have landed tens of millions of pounds from the area in a year, National Fisherman reported.

This month, a New York agency announced it was unable to move forward with three planned projects, some of which overlapped with scallop grounds, as a result of issues with the larger proposed turbine, and the fishing industry celebrated the news.

Annie Hawkins, executive director of the Responsible Offshore Development Alliance (RODA), called the Biden administration’s latest offshore wind announcement a “mixed bag.”

“We’ve been requesting more regularity and notice in the leasing process and are therefore strongly hopeful that having an advance schedule will give BOEM ample time to conduct up-front, comprehensive, and programmatic environmental review in advance of any future leasing decisions,” Hawkins said by email.

She criticized that the federal government made the announcement at “an exclusive conference of offshore wind developers” instead of a range of stakeholders, including the fishing industry and ratepayers.

“It goes without saying that we remain highly concerned about the impacts of this many additional leases,” Hawkins said. “BOEM should work with states, fishing industry members, energy security experts, and environmental justice communities prior to issuing new leases to ensure appropriate siting, mitigation, and decommissioning occur under affordable conditions for ratepayers, before rushing to sell more areas creating uncertainty for all parties involved.”

Mayor Jon Mitchell called the news a “positive development” for the industry and the Port of New Bedford for staging and supporting the maintenance of projects. But he also stressed the importance of designating lease areas in the New York Bight responsibly.

In 2021, he and the fishing industry pushed for a 5-mile buffer across some of the bight leases; BOEM conceded a 2.5-mile buffer.

“It will be important, of course, that future lease areas are developed in a way that respects the interests of the commercial fishing industry, especially in the New York Bight which is one of the leading areas for scallop fishing,” he said in an email statement.

Massachusetts Energy and Environmental Affairs Secretary Rebecca Tepper also applauded the news, stating it will help support up to 32 gigawatts of offshore wind in New England.

“This emerging industry is well supported by the New Bedford port, which is at the forefront of offshore wind development and poised to serve many of the new lease areas,” she added.

Other wind conference takeaways:

Turbines + ports: Federal officials, turbine suppliers and developers are weighing the pros and cons of upscaling turbine size. The next round of projects built out of Massachusetts will use 15-megawatt turbines, but there is global discussion of growing to 18 megawatts — and even bigger for floating wind.

A benefit for larger turbines is fewer foundations installed in the seafloor to meet energy contracts, which could reduce fisheries and habitat impacts. However, experts say growing too quickly increases project risk as the components and technology may not be tested or ready. The latest example of this is in New York, where the state agency had to abandon three projects because they hinged on an 18-megawatt turbine that was not available. The National Renewable Energy Laboratory is set to release a report on the impacts and risks of turbine growth.

Additionally, fast turbine upsizing may not allow enough time for the necessary infrastructure (ports, vessels) to catch up and accommodate the larger components.

Termed “enabling infrastructure,” ports and vessels can serve as significant bottlenecks to getting steel in the water, even if the turbine supply is available. Port officials at the conference addressed this issue, stating size and weight of turbine components factor heavily into the decisions they make when designing and building their ports.

“I think the port team has relayed size is a concern even as we’re building what we hope is a future-proof port,” said Dan Fatton, director for offshore wind at the New Jersey Economic Development Authority, which is developing a major marshaling and manufacturing port.

Bruce Carlisle, director of offshore wind at MassCEC, during a panel discussion noted the New Bedford Marine Commerce Terminal was built about a decade ago, and as such, has “some constraints” as a facility. However, he said MassCEC will soon roll out a “very, very significant” expansion project at the site, and will share more information in the coming months.

Fisheries compensation: BOEM still has no official date when it expects to release its final guidance for developers to compensate the fishing industry. The agency hopes to issue it by the end of the year. Officials, however, say the draft version has been informing project review. Concurrently, the search for a fund administrator continues by the 11 states working on a regional compensation fund, with plans to make an award in the next month or two.

After that, the selected administrator — with oversight from a committee formed by developers, the fishing industry and states — will design the fund.

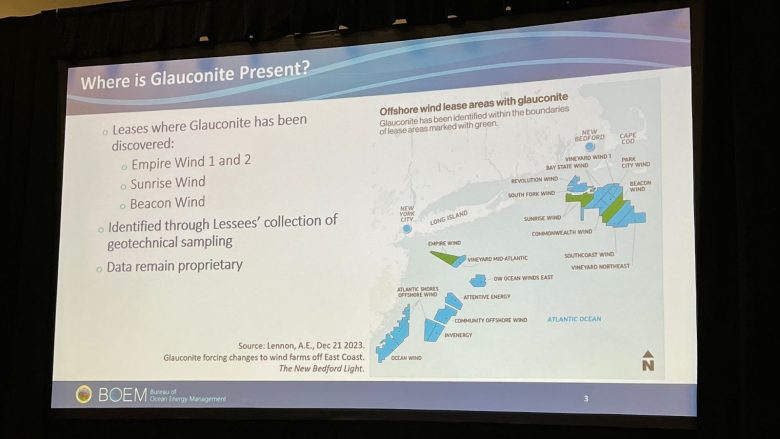

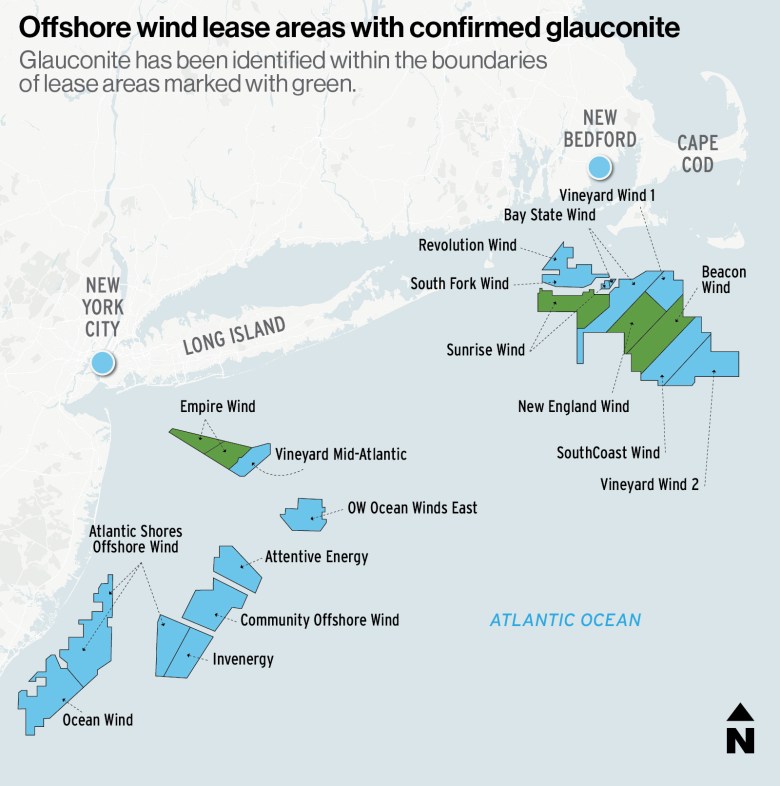

Glauconite: BOEM cited The Light’s reporting (and mapping) of offshore wind leases with glauconite in its presentation during a panel devoted to the problematic soil.

“One of the topics that has come to a head for sure is glauconite,” said George Hagerman, offshore wind techno-economic lead at the National Renewable Energy Laboratory. “The regulatory impact of glauconite can be summed up in that it’s eliminating not just one or two turbine positions, but dozens of turbine positions in East Coast lease areas. And that translates to many, many 10s of megawatts … the industry is taking a hit because it really constrains environmental alternative layouts.”

Not all developers are including sufficient geotechnical data in their construction and operations plan (COP) regarding glauconite and the feasibility of the turbine foundations. Hagerman said not every COP has looked at all three factors — thickness, depth and concentration — which inform not only how the glauconite will behave, but also the risk of pile refusal for turbine installation.

The real world impact, or “lessons learned” as BOEM phrased it, happened with the Sunrise Wind project, in which several turbine positions were deemed no longer viable. This limited project alternatives, which were proposed to minimize fisheries or other environmental impacts.

BOEM also noted the mitigation techniques to address the glauconite challenge — such as increasing the energy used to hammer the piles, or drilling out clogs from the pile as it’s installed — have acoustic and environmental impact implications.

Zachary Westgate, professor of civil engineering at UMass Amherst and a researcher on the industry-funded glauconite project, shared an overview of how different turbine foundations would be affected. Suction bucket foundations, for example, can avoid glauconite layers as the foundations don’t reach as deep into the seafloor.

He also said another phase of research may soon begin. To date, Avangrid, RWE, Equinor, Orsted and Attentive Energy are the developers funding this research project.

The topic of glauconite came up at other points throughout the four-day conference.

Geotechnical engineers raised it during a discussion on pile installation risks. And Michael Brown, CEO of SouthCoast Wind, said glauconite is one of the key challenges for offshore wind development on the U.S. East Coast. He said the industry must ensure it has the technology to meet the challenging “ground conditions.”

The Light has updated its glauconite map based on new information obtained through Freedom of Information Act requests. Per BOEM emails, New England Wind (a two-phase project formerly named Park City Wind and Commonwealth Wind) contains glauconite.

A spokesperson with Avangrid has not responded to a question on whether glauconite is limited to only New England Wind 1 or New England Wind 2.

To learn everything you need to know about glauconite, check out The Light’s coverage.

Email Anastasia E. Lennon at [email protected].

More stories by Anastasia E. Lennon

The post Offshore wind expansion will rely on ports, including New Bedford appeared first on The New Bedford Light.